About Us

Empowering Businesses Through Expertise

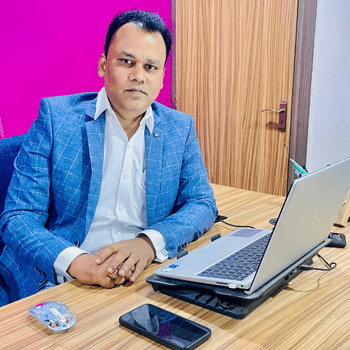

CA. Sarada Prassanna Swain, FCA, Founding Partner

CA. Sarada Prasanna Swain, FCA, Founding Partner | Corporate Law & Financial Strategy Expert CA. Sarada Prasanna Swain brings a significant depth of professional experience and sharp legal and financial acumen to the firm. With a distinguished career in corporate law and financial strategy, he is a recognized expert in Income Tax. He has successfully spearheaded numerous audit and advisory engagements for a diverse clientele, encompassing both corporate and non-corporate entities. CA. Swain’s incisive analytical mindset and unwavering dedication to excellence make him an invaluable partner for clients aspiring to achieve long-term financial clarity, robust compliance, and strategic advantage. He is passionate about helping clients navigate complex financial landscapes and realize their business objectives.

Key Areas of Expertise:

- Corporate Law Advisory

- Income Tax Advisory

- Statutory & Tax Audits

- Internal & Bank Audits

- Society & Trust Audits

- Financial Planning & KPO Services

- Representation before Regulatory Authorities

CA. Chidananda Adhikari, FCA, Founding Partner

GST & Audit Specialist CA. Chidananda Adhikari is a highly respected and seasoned professional, renowned as a trusted name in the intricate fields of taxation and auditing. His extensive experience and profound expertise in GST laws, adept understanding of income tax regulations, and comprehensive grasp of financial systems establish him as the premier advisor for businesses across a multitude of sectors. CA. Adhikari’s client-focused methodology and insightful strategic counsel ensure that businesses not only maintain impeccable compliance but also achieve sustainable growth and prosperity. He is committed to delivering tailored solutions that address the unique challenges and opportunities of each client.

Key Areas of Expertise:

- GST Advisory & Compliance

- Income Tax Advisory

- Statutory & Tax Audits

- Government & Bank Audits

- Internal Audits

- Society & Trust Audits

- Financial Planning

- Project Report Preparation

- Representation before Tax Authorities

Expert advice on company law compliance and governance.

- Company formation and compliance support .

- Drafting and reviewing legal documents.

- Guidance on mergers, acquisitions & restructuring.

- ROC filings and regulatory compliance .

Smart tax planning and compliance solutions.

- Expert tax planning for individuals and businesses.

- Timely filing of income tax returns.

- Assistance with tax assessments and notices.

- Guidance on deductions and exemptions.

Accurate audits ensure legal and financial compliance.

- Ensures legal and regulatory compliance.

- Identifies financial risks and irregularities.

- Enhances transparency and credibility.

- Supports accurate tax reporting and filing.

Thorough audits to improve controls and reduce risks.

- Ensure accuracy in financial reporting.

- Identify and reduce operational risks.

- Strengthen internal controls and compliance.

- Enhance transparency for stakeholders.

01

01

Consultation

We understand your needs through a detailed discussion.

02

02

Strategy & Planning

We craft customized financial and compliance solutions.

03

03

Execution & Support

We implement solutions with ongoing guidance and accuracy.

Testimonial

What They’re Saying?

SPCA’s team provided exceptional tax advice that saved us time and money. Highly professional and reliable!

Riya S.

Business Owner

Their thorough audit process gave us complete confidence in our financials. Truly outstanding service.

Ajay Kumar

CFO

SPCA’s corporate law advisory helped us navigate complex regulations with ease. Highly recommend!

Neha Mohanty

Startup Founder

Prompt, clear, and trustworthy—SPCA has been an invaluable partner for all our accounting needs.

Vikram Pattnaik

Entrepreneur